“Crypto, miner, market correlation, eternal futures: understanding a complex relationship”

The world of cryptocurrencies has increased exponentially in recent years, while millions of investors have plunged on platform trafficking such as Coinbase, Binance and Kraken. One of the key factors of this increase in popularity is the emergence of miners who use specialized hardware to verify transactions on public blockchain.

Miners play a decisive role in maintaining the integrity and safety of the cryptomena networks because they are responsible for solving complex mathematical problems that help ensure the network and verify transactions. In return for their efforts, miners are rewarded with newly minted coins or tokens that have been historically bound to traditional fiat names for a fixed exchange rate.

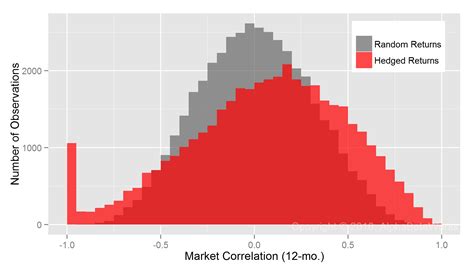

However, the relationship between crypt prices and miner activity has been increasingly correlated in recent years. As the mining force increases, this may lead to a sharp increase in demand for cryptocurrency, causing a rapid rise in prices. On the contrary, when miners slow down by increased competition or disturbances in the supply chain, prices tend to decline.

This correlation is not limited to traditional cryptocurrencies such as bitcoins (BTC) and Ethereum (ETH). The price of other altcoins, such as prices derived from Stablacoins, is also increasingly correlated with Minenic activity. For example, the Litecoin Award (LTC) was updated in 2018, when the algorithm was updated to increase its block reward, highly correlated with mining force.

But what does this mean for investors? Although correlation may be a strong force in increasing prices, it is also necessary to understand that past performance may not necessarily indicate future results. In fact, some altcoins have experienced significant prices, despite the increased activity of miner, such as the collapse of Terra (Luna) and Cosmos (Atom).

On the other hand, futures perpetual futures offers investors a unique opportunity to speculate about cryptocurrencies without actually buying or holding physical assets. These contracts allow traders to lock profits at a fixed price regardless of market fluctuations.

Permanent futures is traded on centralized platforms such as CME Group and IG Markets, where they often correlate with traditional financial markets, such as the S&P 500 index. market.

Key Roads:

1.

- Perpetual futures contracts offer a unique opportunity for speculation : Washing at a fixed price can be attractive to investors who want to ensure market volatility.

3

Market correlation is not always reliable

: Although correlation can raise prices, the past does not guarantee future results.

4.

Investor guide:

If you are a newcomer to invest a cryptocurrency, it is necessary to understand the relationship between the miners’ activity and the fluctuation of prices. Here are a few key messages:

- Monitor reports and trends in the market related to mining and cryptocurrencies.

- Create a risk management strategy that includes ensuring potential price drops or increasing miner activity.

- Consider the use of valid futures contracts as a speculative tool, but be aware of the risks associated with correlated markets.

By understanding the complex relationship between crypt, market correlation and permanent futures, investors can make more informed decisions about their investments.